NCERT Solutions for Class 10 Economics Chapter 3 Money and Credit provides a clear guide to understanding money and credit. This chapter explains how money evolved from a barter system to modern currency, its importance in transactions, different forms of money and the role of banks in providing loans.

These solutions provide detailed, step-by-step explanations to help students understand the content and prepare well for the examinations.

Class 10 Economics Chapter 3 Money and Credit

Ncert Solution

Question 1: In situations with high risks, credit might create further problems for the borrower.

Explain.

Answer: In high-risk situations, the loan can create many problems for the borrower. Such as

1. If the loan is not repaid on time, the borrower is forced to give his property to the lender to be used as a guarantee.

2. If a farmer takes a loan for crop production and the crop fails, then to repay the loan, the farmer may have to sell a part of his land which makes the situation worse than before.

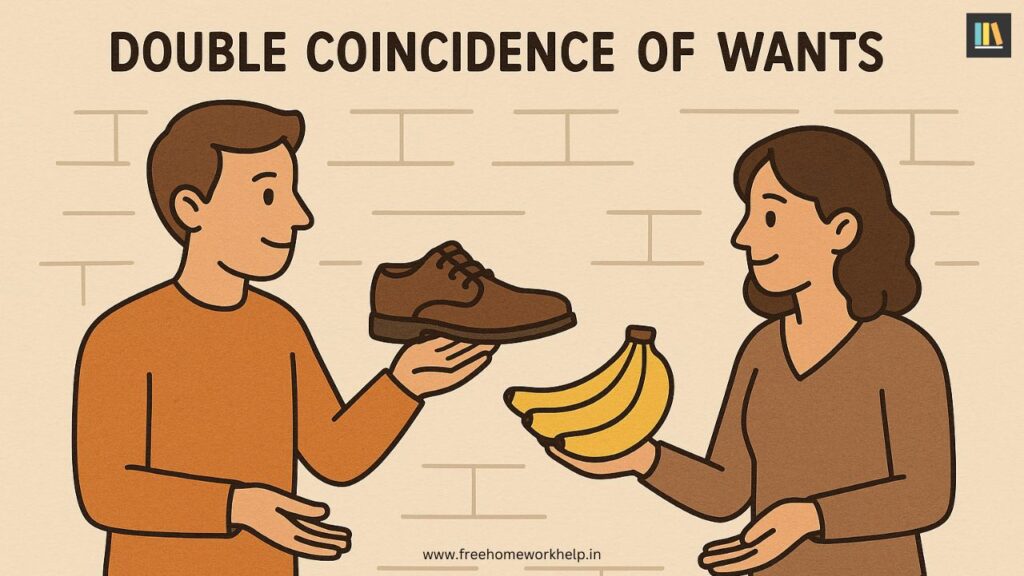

Question 2: How does money solve the problem of double coincidence of wants? Explain with an

example of your own.

Answer: Money overcomes the need for a double coincidence of wants and the difficulties associated with the barter system by acting as a medium of exchange.

For example it is no longer necessary for the farmer to look for a book publisher who will buy his grain and also sell him books. He has only to find a buyer for his grain. If he has converted his grain into money, he can buy any goods or services he needs.

Question 3: How do banks mediate between those who have surplus money and those who need money?

Answer: People who have excess money deposit it in banks and banks pay interest on it. Banks keep only 15 per cent of their deposits as cash to pay the depositors who come to withdraw money from the bank.

Banks use a larger part of the deposits to lend to people who need money.

Thus, banks mediate between people who have excess money and those who need money.

Question 4: Look at the Rs 10 note. What is written above? Can you explain this statement?

Answer: “Reserve Bank of India” and “Guaranteed by the Government” are written Above.

It means that the currency is authorized or guaranteed by the central government. It is legal as a medium of payment that cannot be refused in setting transactions in India.

Question 5: Why do we need to expand formal sources of credit in India?

Answer: We need to expand formal sources of credit in India because-

- Formal credit helps protect borrowers from exploitation by providing loans at low interest rates. Many people take loans from moneylenders who charge very high interest rates.

- 3. Formal credit helps bridge economic inequalities by providing financial services to a greater number of people, including small farmers, entrepreneurs, and low-income groups.

- Formal credit allows individuals and businesses to invest in education, farming, trade, and industries, thereby boosting productivity and overall economic growth.

- Formal credit institutions are regulated by authorities such as the RBI, which ensures better transparency, safety, and legal protection for both lenders and borrowers.

- Formal sources help people increase their chances of getting loans for major needs in the future such as housing, education or business expansion.

Question 6: What is the basic idea behind the SHGs for the poor? Explain in your own words.

Answer: The basic idea behind self-help groups is as follows:

To provide financial resources for the poor by organising the rural poor, especially women, into small self-help groups.

To organise the rural poor, especially women, into small self-help groups.

To pool the savings of its members.

To provide loans without any collateral.

To provide timely loans for various purposes.

To provide loans at low interest rates.

To provide a platform for discussing and taking action on various social issues like education, health, nutrition, domestic violence, etc.

Question 7: What are the reasons why the banks might not be willing to lend to certain borrowers?

Answer: The banks might not be willing to lend to certain borrowers due to the following reasons:

- If a borrower has a history of late payments or bankruptcy, banks may consider them high risk and refuse to lend.

- Borrowers with insufficient income may not be able to make regular loan repayments, making banks hesitant to lend.

- If a borrower already has a large amount of outstanding debt, banks may be concerned about their ability to manage additional debt.

- Without adequate collateral, banks may refuse to lend.

- If the borrower cannot clearly explain why he needs a loan, banks may not be willing to take the risk.

Question 8: In what ways does the Reserve Bank of India supervise the functioning of banks? Why is this necessary?

Answer:

- RBI provides licenses to banks and sets rules for their operation to ensure financial stability.

- The Reserve Bank of India monitors the amount of loans given by banks and the amount of cash balances.

- It also gives loans to small farmers, small industries and small borrowers.

- It reports to RBI from time to time on how many loans were given, to whom and at what interest rate.

- RBI protects the money of depositors and builds public confidence in the banking system.

It is necessary to maintain equity in the financial sector and provide opportunities for small industries to grow.

Question 9: Analyse the role of credit for development.

Answer: Credit plays a vital role in the development of the country in the following ways:

- It helps individuals and businessmen to grow their businesses, leading to job creation and economic growth.

- It improves agricultural productivity. Farmers can use credit to purchase better seeds, equipment, and fertilizers, which increases crop yields and promotes rural development.

- It supports education and health. Anyone can use credit to invest in education and healthcare, which improves human capital.

- It reduces poverty and inequality and improves their livelihoods.

- Governments and the private sector use credit to fund large-scale infrastructure projects such as roads, schools, and hospitals, which are essential for national development.

Question 10: Manav needs a loan to set up a small business. On what basis will Manav decide whether to borrow from the bank or the moneylender? Discuss.

Answer: Manav will decide whether to take a loan from a bank or a moneylender based on the following loan terms:

- Interest rate

- Requirements

- Availability of collateral

- Documents required by the banker.

- Mode of repayment.

Question 11: In India, about 80 per cent of farmers are small farmers, who need cultivation.

(a) Why might banks be unwilling to lend to small farmers?

(b) What are the other sources from which the small farmers can borrow?

(c) Explain with an example of how the terms of credit can be unfavourable for the small farmer.

(d) Suggest some ways by which small farmers can get cheap credit.

Answer: (a) Banks may be unwilling to lend to small farmers because loan repayment depends on the income from farming. And if the crop fails, it becomes impossible to repay the loan. In such a situation, recovery of loans from small farmers becomes very difficult.

(b) The other sources from which the small farmers can borrow are-

- local money lenders,

- agricultural

- traders,

- big landlords,

- cooperatives,

- SHGs etc

(c) In case of crop failure, the loan terms can be unfavourable for small farmers because, in this situation, it becomes impossible for them to repay the loan. And he has to sell a part of his land to repay the loan.

(d) Small farmers can get cheap loans from cooperative societies, agricultural societies, SHGs etc.

Question 12: Fill in the blanks:

- The majority of the credit needs of the __________households are met from informal sources.

- __________costs of borrowing increase the debt-burden.

- __________issues currency notes on behalf of the Central Government.

- Banks charge a higher interest rate on loans than what they offer on __________.

- _________is an asset that the borrower owns and uses as a guarantee until the loan is repaid to the lender.

Answer:

- poor

- High

- Reserve Bank of India

- deposits

- Collateral

Question 13: Choose the most appropriate answer.

(i) In an SHG most of the decisions regarding savings and loan activities are taken by

(a) Bank.

(b) Members.

(c) Non-government organization.

(ii) Formal sources of credit do not include

(a) Banks.

(b) Cooperatives.

(c) Employers.

Answer:

(i) (b) Members.

(ii) (c) Employers.

Read More: Development Class 10 Notes

FAQ | Class 10 Economics Chapter 3 Money and Credit

1. What is Barter System?

Barter System is an exchange of goods and services without using money.

2. What is main source of income for banks?

Difference between the interest charged on borrowers and depositors.

3. Who issues the currency notes on behalf of the Central Government?

The Reserve Bank of india

Conclusion

I hope the information given above regarding Class 10 Economics Chapter 3 Money and Credit has been helpful to you. If you have any other queries about NCERT Class 10 Economics Chapter 3 Money and Credit, feel free to reach us so that we can get to you at the earliest possible.